Revenue‑based financing | Luminor

Revenue‑based financing

Revenue‑based financing

Innovative revenue‑based working capital funding for merchants using POS to grow your business and reach new goals.

- Quick access to funding

- No fixed installments

- Simple and transparent

Within 24 hours

Fully digital process allows for record‑breaking loan disbursement speeds. No paper, no long forms, no stress.

No collateral

Your business performance data is sufficient proof, and the revenue‑based financing model provides all the necessary guarantees.

No fixed installments

Loan repayments will be done automatically, as an agreed percentage of your income collected at Luminor POS terminals. When your business are successful, loan repayment will be bigger. When purchases slow down, the repayments will also slow down.

One‑time fee only

Financing is provided upon payment of a one‑time loan fee – with no hidden costs.

Embedded lending with Softloans

Softloans is a financial technology company founded in Lithuania, whose goal is to simplify and modernize the loan process for small and medium-sized businesses.

Softloans provides both technology and funds for revenue-based loans to boost your business.

How to get revenue‑based financing?

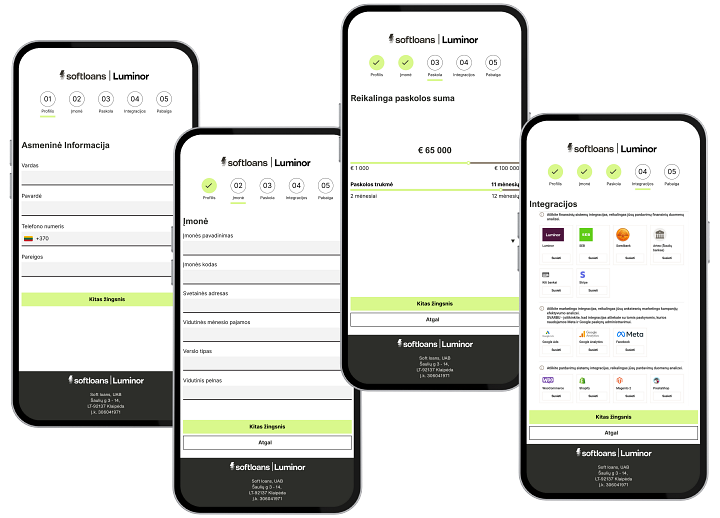

1. Create an account on Softloans platform

2. Share main company and CEO details

3. Choose the required financing amount

4. Submit your business financial data through simple integrations

That's it! Your financing application is submitted to Softloans. You will receive a financing offer within 24 hours.

Once you accept the offer, you'll sign the credit agreement directly with Softloans, and their terms, conditions and privacy policy will apply.

Frequently asked questions

Legal entities that have been operating for more than 6 months and have at least EUR 3,000 average turnover per month can receive financing. It is also important that Luminor POS terminals are used at the points of sale.

The service is subject to a one‑time fee, which can be from 10 % of the loan amount. Here is what a typical loan example might look like:

- Loan amount EUR 9,000..

- Duration up to 12 months.

- One‑time administration fee – 10 % (EUR 900).

- Loan interest – 0 %.

- Early loan repayment fee – none.

- Repayment schedule – 15 % of the revenue collected through Luminor POS terminals are allocated for loan repayment until full loan amount is paid out.

- Clear cost of money and no interest: the recipient of revenue‑based financing knows the exact cost of money before receiving the loan – it does not change and is paid as a one‑time loan fee at the time of loan disbursement.

- No collateral: business performance data is sufficient proof, and the revenue‑based financing model provides all necessary guarantees.

- No loan repayment schedule: loan repayment adapts to business revenue. Repayment is automatic, directing an agreed percentage of business revenue to loan repayment.

By analyzing the data from your submitted bank accounts and payment service providers, Softloans evaluates historical income data and trends from previous periods.

Only through these integrations is it possible to implement a revenue-based financing model, without requiring collateral or applying a fixed repayment schedule. The obtained data helps to properly assess the business's growth potential and provide the most suitable financing offer.

The integrations do not require technical knowledge. If needed, short video tutorials available in the integrations section or the Softloans team will assist you.

Softloans is Luminor's technology solutions partner, creating technological solutions that help small and medium‑sized business representatives easily and quickly obtain the working capital needed for growth. Softloans is a technology company founded in Lithuania, aiming to simplify and modernize the loan process for small and medium‑sized businesses.