Let the happy days roll!

- Liberation day 2.0 that did not come

- Central banks at the crossroads

- Earnings reports show the momentum intact

The month of July has truly captured the markets with the upbeat tone, as major stock indexes continued rising, while bond markets have remained relatively calm. Recovering from the April shock, financial markets have kept their resilience in the face of challenging macroeconomic backdrop and the looming tariff deadlines. Investors’ optimism has been supported by relatively strong corporate earnings’ reports, as majority of companies in the US have exceeded the analysts’ expectations, thus building the narrative of resilience in the face of economic and political uncertainty.

In July the developed markets’ equities (measured by MSCI World index in EUR) rose 3.82%, while emerging markets’ equities (measured by MSCI Emerging Market index in EUR) jumped 4.56%. During the same period yields on bonds were rising slightly, with 10‑year U.S. Treasury bond yields rising to 4.36% from 4.23% a month ago, while German 10‑year Treasury bond yields rose as well to 2.69% - up by 0.1‑0.2% compared to the previous month levels.

Liberation day deadlines

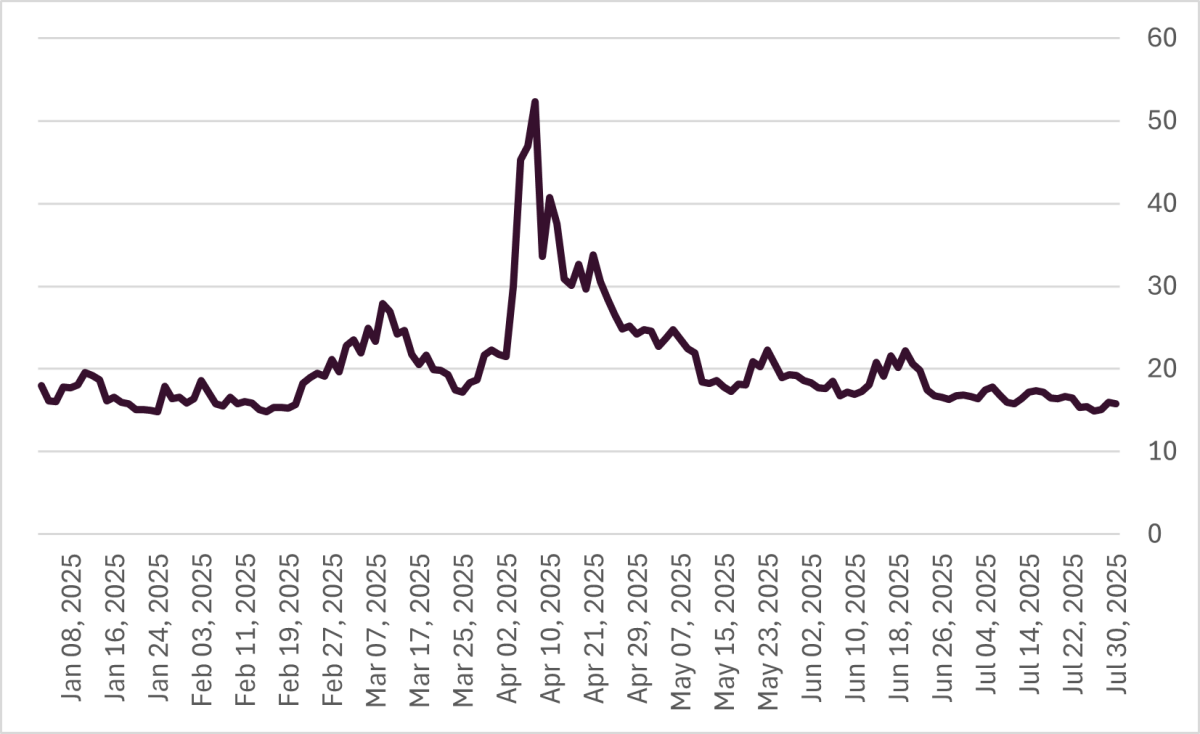

The July 9th trade tariff deadline, set by President Trump as the end of a 90‑day pause on sweeping import duties, became a pivotal moment in global trade diplomacy. The U.S. administration used the deadline to pressure allies and trading partners to reduce Chinese content in their exports and finalize bilateral trade deals. Despite the looming threat of tariffs as high as 50% on European goods and up to 49% on imports from countries like Japan and Cambodia, financial markets remained surprisingly calm. The S&P 500 had already surged subtantially from April lows, buoyed by optimism that a full‑scale trade war could be avoided. Implied volatility, as measured by the VIX index, stayed near yearly lows, reflecting investor confidence in a diplomatic resolution.

This assessment has turned out to be at least partially correct, as the trade agreements with the EU, Japan and South Korea were announced late in the month. Although these agreements involved additional tariffs compared to the pre‑Trump presidency period, markets have reacted largerly positively as the risk of escalation between the trading partners was seen as diminished.

VIX index value has remained low

Source: Investing.com

Central banks’ decisions

In the late days of July the Federal Reserve (FED) held its benchmark interest rate steady at 4.25% to 4.5%, resisting political pressure from President Trump to cut rates. Despite signs of muted inflation and a stable job market, the Fed maintained its cautious stance, citing uncertainty around the economic impact of tariffs. Market participants now will be focusing on the next FED’s meeting in September with the odds of an interest rate cut during that meeting being split. Naturally, investors will closely watch out for the hints from the economic data to assess which side the US central bank is leaning over the coming weeks.

European Central Bank (ECB) decided to keep its key interest rates unchanged at 2%, citing inflation stabilizing at its 2% target. The decision reflects a cautious, data‑dependent stance amid heightened global uncertainty and the euro's over 10% appreciation since the beginning of the year, which has pressured export competitiveness. The ECB signaled a “meeting‑by‑meeting” approach going forward, with markets pricing in a potential rate cut in September if inflation softens or trade tensions ease.

Earnings reports’ cheer

A surge of corporate earnings reports from major firms like Coca‑Cola, General Motors, Lockheed Martin, and Alphabet significantly influenced financial markets during the month of July. The S&P 500 and Nasdaq reached record highs, buoyed by strong performances in technology and industrial sectors.

The tech megacap Alphabet exceeded expectations with 14% year‑over‑year revenue growth, reinforcing investor confidence in AI and cloud computing. At the same time, defense and financial companies also posted solid results, with earnings surprises boosting market sentiment. The rally was broad‑based, with cyclical sectors like Industrials and Financials leading gains, while Healthcare and Consumer Discretionary lagged.

Overall, July’s earnings season acted as a catalyst for bullish momentum, despite lingering concerns over inflation, interest rates, and global trade.

Market view

Many market participants have expressed their concerns over the political and economic uncertainty unleashed by the US presidential administration. This sentiment does not seem to echo with the general dynamic in the financial markets, which have stayed largely resilient while facing the challenges. Financial markets may draw some optimism from the numerous trade agreements with the US, having avoided significant worsening of economic and political ties between the major economies.

With that in mind, the investors will focus on the data for further signs of how the updated global trade policy is affecting the macroeconomic backdrop. Should the data show significant stress appearing as a result, it is justifiable to expect some changes to the recent narrative of the financial markets.

Warnings:

- This Marketing Communication is not considered investment research and has not been prepared in accordance with standards applicable to independent investment research.

- This Marketing Communication does not limit or prohibit the bank or any of its employees from dealing prior to its dissemination.

Origin of the Marketing Communication

This Marketing Communication originates from Portfolio Management unit (hereinafter referred to as PMU) – a division of Luminor Bank AS (reg. No 11315936, with registered address at Liivalaia 45, 10145, Tallinn, Republic of Estonia, hereinafter - Luminor). PMU is involved in the provision of discretionary portfolio management services to Luminor clients.

Supervisory authority

As a credit institution Luminor is subject to supervision by the Estonian financial supervision and resolution authority (Finantsinspektsioon). Additionally, Luminor is subject to supervision by the European Central Bank (ECB), which undertakes such supervision within the Single Supervisory Mechanism (SSM), which consists of the ECB and the national responsible authorities (Council Regulation (EU) No 1024/2013 - SSM Regulation). Unless set out herein explicitly otherwise, references to legal norms refer to norms enacted by the Republic of Estonia.

Content and source of the publication

This Marketing Communication has been prepared by PMU for information purposes. Luminor will not consider recipients of this Communication as its clients and accepts no liability for use by them of the contents, which may not be suitable for their personal use.

Opinions of PMU may deviate from recommendations or opinions presented by the Luminor Markets unit. The reason may typically be the result of differing investment horizons, using specific methodologies, taking into consideration personal circumstances, applying a specific risk assessment, portfolio considerations or other factors. Opinions, price targets and calculations are based on one or more methods of valuation, for instance cash flow analysis, use of multiples, behavioural technical analyses of underlying market movements in combination with considerations of the market situation, interest rate forecasts, currency forecasts and investment horizon.

Luminor uses public sources that it believes to be reliable. However, Luminor has not performed independent verification. Luminor makes no guarantee, representation or warranty as to their accuracy or completeness. All investments entail a risk and may result in both profits and losses.

This Marketing Communication constitutes neither a solicitation of an offer nor a prospectus in the sense of applicable laws. An investment decision in respect of a financial instrument, a financial product or an investment (all hereinafter “product”) must be made on the basis of an approved, published prospectus or the complete documentation for such a product in question and not on the basis of this document. Neither this document nor any of its components shall form the basis for any kind of contract or commitment whatsoever. This document is not a substitute for the necessary advice on the purchase or sale of a financial instrument or a financial product.

No Advice

This Marketing Communication has been prepared by Luminor PMU as general information and shall not be construed as the sole basis for an investment decision. It is not intended as a personal recommendation of particular financial instruments or strategies. Luminor accepts no liability for the use of the Marketing Communication content by its recipients.

If this Marketing Communication contains recommendations, those recommendations shall not be considered as an objective or independent explanation of the matters discussed herein. This document does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the persons who receive it. The securities or other financial instruments discussed herein may not be suitable for all investors. The investor bears all risk of loss in connection with an investment. Luminor recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors if they believe it necessary.

The information contained in this document also does not constitute advice on the tax consequences of making any particular investment decision. The estimates of costs and charges related to specific investment products are not provided therein. Each investor shall make his/her own appraisal of the tax and other financial advantages and disadvantages of his/her investment.

Risk information

The risk of investing in certain financial instruments, including those mentioned in this document, is generally high, as their market value is exposed to many different factors. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. When investing in individual financial instruments the investor may lose all or part of their investments.

Important disclosures of risks regarding investment products and investment services are available here.

Conflicts of interest

To avoid occurrence of potential conflicts of interest as well as to manage personal account dealing and / or insider trading, the employees of Luminor are subject to the internal rules on sound ethical conduct, management of inside information, and handling of unpublished research material and personal account dealing. The internal rules have been prepared in accordance with applicable legislation and relevant industry standards. Luminor’s Remuneration Policy establishes no link between revenues from capital markets activity and remuneration of individual employees.

The availability of this Marketing Communication is not associated with the amount of executed transactions or volume thereof.

This material has been prepared following the Luminor Conflict of Interest Policy, which may be viewed here.

Distribution

This Marketing Communication may not be transmitted to, or distributed within, the United States of America or Canada or their respective territories or possessions, nor may it be distributed to any U.S. person or any person resident in Canada. The document may not be duplicated, reproduced and(or) distributed without Luminor’s prior written consent.