How to use a bank card safely?

Secure online payments FAQ

Contactless FAQ

Cards.

Frequently asked questions

Cards.

Frequently asked questions

You can active your payment card on the Internet Bank or Mobile Bank.

On Internet Bank

On Mobile Bank

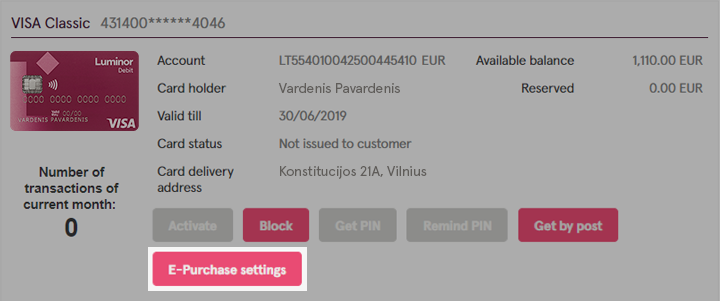

1. On the Cards page, click E-Purchase settings

2. Click Activate service

3. Enter your phone number; this is where the confirmation SMS will be sent. Also enter a personal greeting so that you know it is your purchase you’re confirming.

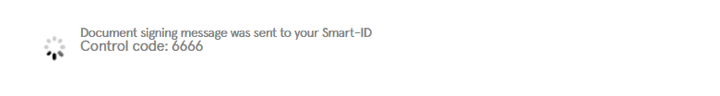

4. Confirm

5. Finished!

You can disable the contactless function on your card:

If you are a business customer and would like to receive a PIN code reminder, please contact us by phone +370 5 239 3444 or write a letter in the Internet Bank.

If you are a private customer*, you can check your payment card’s PIN code on Internet Bank or Mobile Bank.

On Internet Bank:

On Mobile Bank:

*Exceptions apply when the card is issued to a person other than the account owner, or the cardholder is a minor. To receive a PIN reminder, contact us by phone at +370 5 239 3444 or send a letter in the Internet Bank.

Block your card immediately via the Internet Bank or by contacting Luminor Customer Support calling +370 5 239 3444, writing online or [email protected].

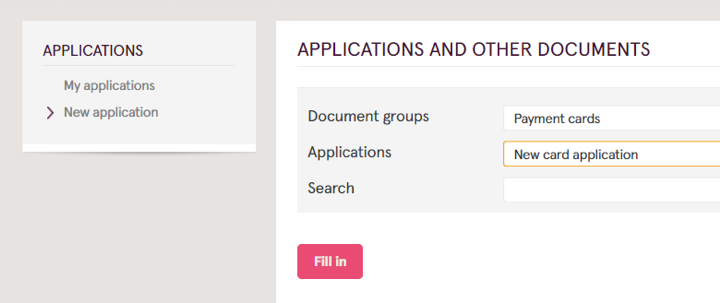

You can order a new card via the Internet Bank.

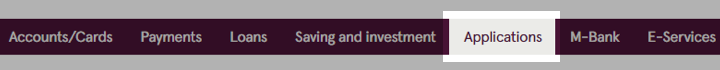

1. Select Applications

2. Click New application and select New card application

3. Fill in the application

4. Sign the application

You can find your nearest Luminor ATMs here.

Contact Luminor Customer Support online by writing to [email protected] or calling +370 5 239 3444.

Your new card should arrive within five working days. If you chose to receive your card’s PIN code on paper, your PIN code should arrive a couple of days before your card.

Please find cards price lists here.

Please note that due to sanctions issued by the United States Office of Foreign Assets Control, it is not possible to use VISA cards in Iran, Syria, Cuba, and Sudan. In addition, currently, it is not possible to use VISA cards in Crimea and Russia.

Types of cards and applicable standard cash withdrawal and payment transaction limits are presented in the table below.

| Visa Debit | Total amount of cash withdrawal transactions per 24 hours, EUR | 1500 |

|---|---|---|

| Total amount of payments for goods/services per 24 hours, EUR | 4000 | |

| Visa Classic | Total amount of cash withdrawal transactions per 24 hours, EUR | 2000 |

| Total amount of payments for goods/services per 24 hours, EUR | 5000 | |

| Visa Gold Luminor Black |

Total amount of cash withdrawal transactions per 24 hours, EUR | 3000 |

| Total amount of payments for goods/services per 24 hours, EUR | 10000 | |

| Visa Business Visa Business Debit |

Total amount of cash withdrawal transactions per 24 hours, EUR | 3000 |

| Total amount of payments for goods/services per 24 hours, EUR | 8700 |

To change your card’s cash withdrawal and purchase limits, submit an application via the Internet Bank: Applications →& New application, in section Documents groups select Payment cards, in section Applications select Transaction limit change for card payments and cash withdrawals.

We will process your request in 1 business day. We will inform you about the approved and completed request via a message in the Internet bank.

Important! A fee, specified in the Pricelist, is applied for increasing the standard cash withdrawal or payment transaction limits of the payment card. The fee is not applied if the transaction limits of the payment card are changed to standard or lower than standard transaction limits.

Types of cards and applicable standard cash deposit transaction limits are presented in the table below.

| Card type | Total amount of cash deposit transactions per calendar month, EUR |

|---|---|

| Liminor Black Visa Debit Visa Classic Visa Gold |

15,000.00 |

| Visa Business Visa Business Debit |

30,000.00 |

To change your card’s cash deposit transaction limits, submit an application via the Internet Bank: Applications → New application, in section Documents groups select Payment cards, in section Applications select Transaction limit change for card cash deposits.

We will process your request in 5 business days. We will inform you about the approved and completed request via a message in the Internet bank.

During card payment authorization, the transaction amount is reserved in the card-linked payment account. This amount is debited upon receipt of confirmation of the card payment from the payee and then the reservation is released. Reservation is cancelled if no confirmation of the card payment is received from the payee within 9 calendar days from the date of reservation.

According to the rules of the international payment card organization Visa, the reserved amount must be paid to the payee upon confirmation of the card payment.

Reserved amount cannot be cancelled, regardless of card payment method (physical or on-line purchase).

You have the right to dispute a card payment if:

Please note, to be able to initiate a chargeback, first you must try to resolve a dispute with the merchant directly. However, if an agreement with a merchant cannot be reached, we will try to help you to get the paid amount back.

Please fill in an application via Internet bank: Applications → New application, in section Documents groups select Payment cards, in section Applications select Request to investigate a disputed card payment transaction and provide all information related to disputed transaction.

Important! Please provide a detailed description of the situation and any relevant documents (e.g. description of the item or service purchased, photos, copies of order confirmation and correspondence with the seller, evidence that you have cancelled the order or subscription, etc.).

The more information you provide, the more arguments we will have to start the chargeback process.

All related documents must be sent to [email protected]. Please include the application date and the disputed amount in the subject line (example – 2024‑11‑30 amount 235.50).

Please submit your request within 60 calendar days of the date when the funds were debited from your account. Processing time for your request may take up to 100 calendar days.

If you have additional questions, please write to [email protected] or call +370 5 239 3444 during bank business hours.

Block the card immediately! You can do this:

You have the right to dispute unauthorized transactions. Please fill in the request in the Internet bank Applications → New application → in the Documents groups section select Payment cards and in Application section select Request to investigate a disputed card payment transaction.

Please fill in the application via Internet bank Applications → New application → in section Documents groups select Payment cards, in section Applications select Request to investigate a disputed card cash withdrawal/deposit transaction and provide all information related to disputed transaction.

The more information you provide (e.g., the date and time of cash withdrawal or deposit, any technical issues noticed with the ATM or Perlas terminal during the transaction), the sooner we can clarify relevant circumstances and start the investigation.

If a child has access to the internet bank and manages their bank account independently, they can order a payment card via their internet bank.

If the child has no access to the internet bank, a parent/parents who manage the child’s account can order the payment card in the child‘s name.

If your child is a Luminor customer, you can log into your internet bank and order an additional payment card in your child‘s name (Accounts / Cards / New card / submit the required information about your child in the second step).

Yes. Please note that Luminor Debit card can be issued only for children from the age of 6.

Children from the age of 7 can use the internet bank and manage their account independently or jointly with their parents/guardians.

Have questions about our other products?